Understanding how odds work is essential when you bet on sports. There are three types of odds: Decimal, American, and money line odds. You should also understand teasers and pleasers. These odds can help you bet smartly. You can make some big profits if you use them correctly.

Decimal odds

Decimal odds in sports betting are a common phenomenon. These odds are calculated by multiplying the number of units a team has by the stake that the bettor is willing to risk. A $100 wager on the Chiefs winning Super Bowl will yield a $900 payout. This includes $800 in profit, as well as $100 in original bet amount. The same principle applies to sums.

You will find an online decimal odds converter if you wish to bet. This calculator will provide you with both American and decimal odds as well as your chance of winning. The results section will show the winning amount and the total payout. If the odds are 1.69, the bet will win 59% of its time. The risk amount would be paid out to the bettor, if this bet were successful.

Teasers

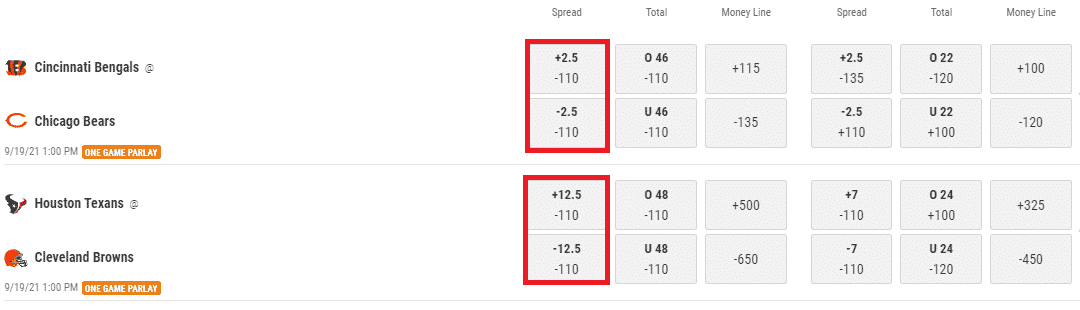

Teasers are sports betting bets that combine two or more sports. There are different rules for teasers. The concept of teasers is the exact same. The odds of winning increase if you wager on more than one team. If one team fails, you have the option to bet on the other. This will increase your chances of winning.

Teasers are very popular in sports betting and can often be profitable if played correctly. Be sure to learn about the types of bets that you can place. Always bet within your budget. Teasers should be used only when the spread seems tight.

Pleasers

The percentages of pleasers within sports betting odds vary from bookmaker, bookmaker, and game to match. Pleasers in football have between 6 and 10 points, while those in basketball tournaments are five points. Also, pleaser bets are available in horse racing as well as rugby.

These bets can be high-risk and should be reserved for very special occasions. If the spread is small enough to make the wager profitable, pleaser bets should be avoided. Pleasers are also difficult to understand and can sometimes be a lottery-type of bet. Pleaser bets are best avoided by a novice bettor, though they can be used in certain situations.

Through lines

If you are a big fan of NFL football, then you may have heard about lines in sports betting. These lines provide an estimate of the total points that a team will score during a match. For example, you might see that the Steelers are favored over the Browns by 3 points. You can identify the best time to place a bet by understanding lines in sports betting odds.

Through lines can shift dramatically in a game. This can make the difference between a small and large profit when placing a betting bet. As you gain experience betting on sports, understanding how the lines move will become second nature. You will learn how to best place your wagers, so you can maximize your profit.

FAQ

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires hard work and effort.

Your active income comes from creating value for someone else. It is when someone buys a product or service you have created. This could include selling products online or creating ebooks.

Passive income is great because it allows you to focus on more important things while still making money. Many people aren’t interested in working for their own money. Instead, they decide to focus their energy and time on passive income.

Problem is, passive income won't last forever. You might run out of money if you don't generate passive income in the right time.

It is possible to burn out if your passive income efforts are too intense. So it's best to start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You're free from worrying about paying rent, utilities, and other bills every month.

It's not enough to learn how money management can help you make more money. You'll be happier all around. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

So who cares about personal finance? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. That leaves only two hours a day to do everything else that matters.

When you master personal finance, you'll be able to take advantage of that time.

What is the limit of debt?

It is vital to realize that you can never have too much money. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. So when you find yourself running low on funds, make sure you cut back on spending.

But how much is too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. For $50,000 you can spend no more than $5,000 each month.

The key here is to pay off debts as quickly as possible. This includes student loans, credit card debts, car payments, and credit card bill. After these debts are paid, you will have more money to save.

You should also consider whether you would like to invest any surplus income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

For example, let's say you set aside $100 weekly for savings. That would amount to $500 over five years. In six years you'd have $1000 saved. You would have $3,000 in your bank account within eight years. It would take you close to $13,000 to save by the time that you reach ten.

At the end of 15 years, you'll have nearly $40,000 in savings. This is quite remarkable. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000, you'd now have more than $57,000.

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

What's the best way to make fast money from a side-hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. It means building a name online and offline.

The best way to build a reputation is to help others solve problems. You need to think about how you can add value to your community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many opportunities to make money online. But they can be very competitive.

You will see two main side hustles if you pay attention. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. You will also find fierce competition for these gigs.

Consulting can help you grow your business without having to worry about shipping products and providing services. However, it takes time to become an expert on your subject.

You must learn to identify the right clients in order to be successful at each option. This takes some trial and errors. But it will pay off big in the long term.

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

It means listening to their needs and desires. It is important to learn how to communicate with people and to sell to them.

The next step is to learn how to convert leads in to sales. To keep clients happy, you must be proficient in customer service.

Every product or service has a buyer, even though you may not be aware of it. Knowing who your buyer is will allow you to design your entire company around them.

To become a millionaire takes hard work. It takes even more to become billionaire. Why? You must first become a thousandaire in order to be a millionaire.

Then, you will need to become millionaire. And finally, you have to become a billionaire. The same is true for becoming billionaire.

How does one become billionaire? It starts with being a millionaire. All you have to do in order achieve this is to make money.

But before you can begin earning money, you have to get started. Let's take a look at how we can get started.

What is the easiest passive source of income?

There are many online ways to make money. Most of them take more time and effort than what you might expect. How can you make it easy for yourself to make extra money?

Finding something you love is the key to success, be it writing, selling, marketing or designing. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

As another source of passive income, you might also consider starting your own blog. This time, you'll need a topic to teach about. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many ways to make money online, but the best ones are usually the simplest. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is known content marketing.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

Get passive income ideas to increase cash flow

It is possible to make money online with no hard work. Instead, there are ways for you to make passive income from home.

Automating your business could be a benefit to an already existing company. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

Your business will become more efficient the more it is automated. This will enable you to devote more time to growing your business instead of running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows your business to be more focused on what is important. You are effectively outsourcing a task and delegating it.

You can concentrate on the most important aspects of your business and let someone else handle the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

Turn your hobby into a side-business. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

You might consider writing articles if you are a writer. You can publish articles on many sites. These sites pay per article and allow you to make extra cash monthly.

It is possible to create videos. Many platforms now enable you to upload videos directly to YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

Investing in stocks and shares is another way to make money. Investing is similar as investing in real property. You get dividends instead of rent.

They are included in your dividend when shares you buy are purchased. The size of the dividend you receive will depend on how many stocks you purchase.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. You will still receive dividends.