The vig term is used to describe how much money sportsbooks charge for taking bets of certain types. This can account for a large part of a bettor's loss or gain.

The term "vig" can be confusing, and it is important to understand what this means for the bet that you are placing. The vig can also be used as a guide to determine how much bet you should place on each bet.

It is the additional fee that sportsbooks charge to accept a wager. Sportsbooks need to be able to make a profit, so they have to take a percentage.

This is the exact same concept as when you give a friend money to borrow and they return a percentage of that amount. They do not have to pay you back the money but they receive a certain amount, known as the vig.

Typically, it's about 10% or so on every dollar bet. This may vary based upon the odds.

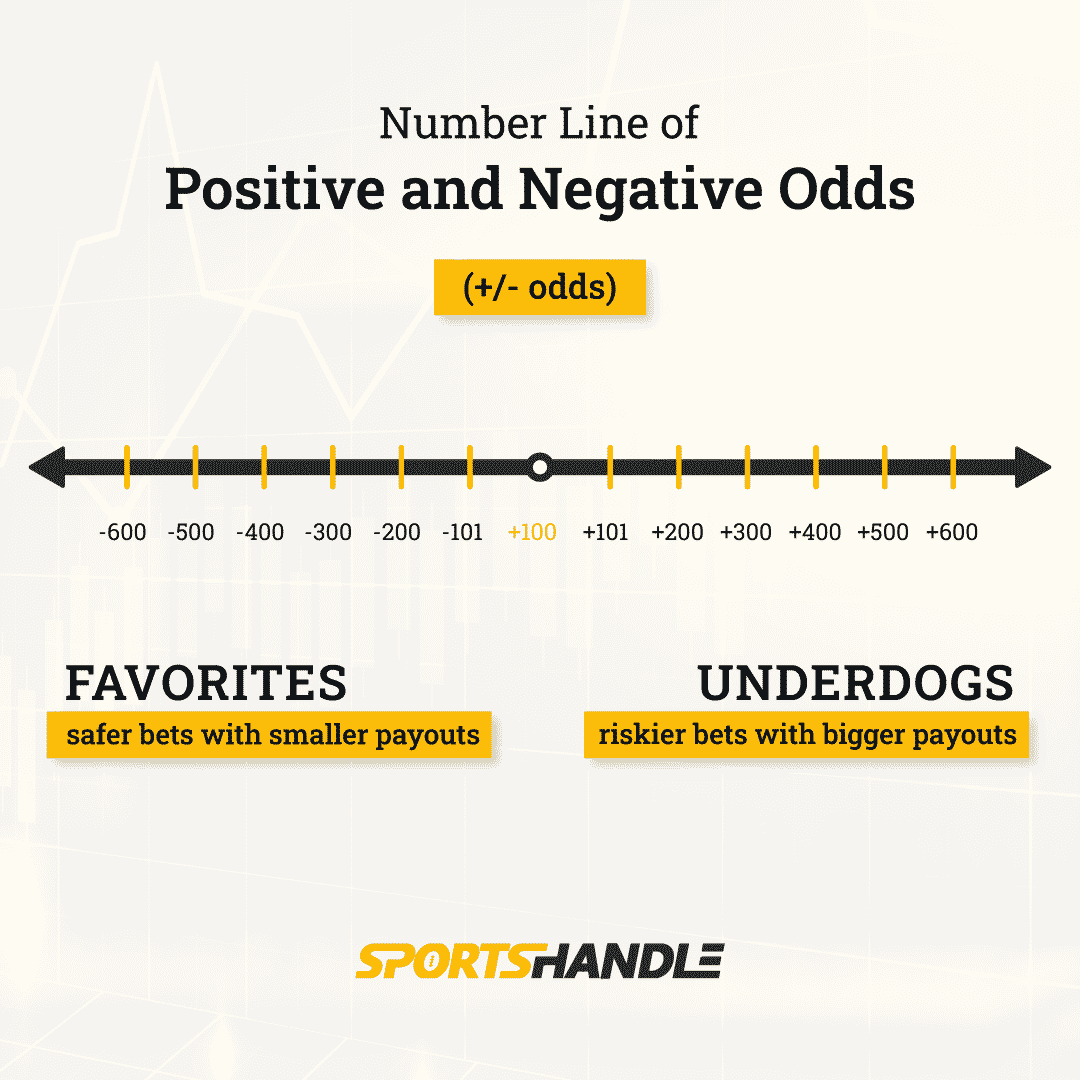

A common example is a vig on moneylines. In this case, two teams have an equal match and no point difference. In these cases, the vig is usually -110 or less for the favorite and -105 or -115 for the underdog.

On the other side, if you have a clear favourite and underdog then the vig could be significantly higher. In these cases, it's a good idea to shop around and find the lowest vig that you can on any given bet.

The vig rate can be thought of as the credit card interest. You will be charged interest on the money you borrow from a loan-shark until you pay it back.

It's not surprising that sportsbooks use a similar system to make a profit. The sportsbook takes a cut of your bet, and they also need to make sure you are betting with them on a consistent basis.

When betting on sports it is easy to get caught up with the excitement and thrill of winning or loosing a game. You should always remember that the vig is there.

You can do this easily. This can mean the difference between someone who is a consistent loser and someone who is a successful bettors. This is especially important if betting on a large scale.

FAQ

How can rich people earn passive income?

If you're trying to create money online, there are two ways to go about it. Another way is to make great products (or service) that people love. This is known as "earning" money.

The second is to find a method to give value to others while not spending too much time creating products. This is "passive" income.

Let's suppose you have an app company. Your job is to create apps. You decide to give away the apps instead of making them available to users. That's a great business model because now you don't depend on paying users. Instead, you rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how the most successful internet entrepreneurs make money today. Instead of making things, they focus on creating value for others.

Why is personal finances important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why do we put off saving money? What is the best thing to do with our time and energy?

The answer is yes and no. Yes because most people feel guilty about saving money. No, because the more money you earn, the more opportunities you have to invest.

Focusing on the big picture will help you justify spending your money.

To become financially successful, you need to learn to control your emotions. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

You may also have unrealistic expectations about how much money you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

How to build a passive stream of income?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

That means understanding their needs and wants. It is important to learn how to communicate with people and to sell to them.

The next step is how to convert leads and sales. To retain happy customers, you need to be able to provide excellent customer service.

Even though it may seem counterintuitive, every product or service has its buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

To become a millionaire it takes a lot. To become a billionaire, it takes more effort. Why? You must first become a thousandaire in order to be a millionaire.

And then you have to become a millionaire. And finally, you have to become a billionaire. The same is true for becoming billionaire.

How do you become a billionaire. Well, it starts with being a thousandaire. All you have to do in order achieve this is to make money.

You must first get started before you can make money. Let's now talk about how you can get started.

What is personal financial planning?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You no longer have to worry about paying rent or utilities every month.

And learning how to manage your money doesn't just help you get ahead. It makes you happier overall. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finance anyway? Everyone does! Personal finance is a very popular topic today. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. That leaves only two hours a day to do everything else that matters.

You'll be able take advantage of your time when you understand personal finance.

What is the fastest way you can make money in a side job?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

Helping others solve problems is the best way to establish a reputation. Consider how you can bring value to the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many opportunities to make money online. But they can be very competitive.

When you really look, you will notice two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each method has its own pros and con. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. You will also find fierce competition for these gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it takes time to become an expert on your subject.

You must learn to identify the right clients in order to be successful at each option. This requires a little bit of trial and error. It pays off in the end.

Which passive income is easiest?

There are many online ways to make money. Most of them take more time and effort than what you might expect. How can you make extra cash easily?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a list with 101 tips and resources for affiliate marketing.

A blog could be another way to make passive income. Again, you will need to find a topic which you love teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many online ways to make money, but the easiest are often the best. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known as content marketing and it's a great way to drive traffic back to your site.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to Make Money Online

The way people make money online today is very different than 10 years ago. It is changing how you invest your money. Although there are many options for passive income, not all require large upfront investments. Some methods are easier than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out which type of investor you are. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. Before you make a commitment to any program, do your research. Look through past performance records, testimonials, reviews. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Don't jump straight into one large project. Instead, you should start by building something small. This will help you learn the ropes and determine whether this type of business is right for you. Once you feel confident enough to take on larger projects.

-

Get started now! It's never too early to begin making money online. Even if your job has been full-time for many years, there is still plenty of time to create a portfolio of niche websites that are profitable. All you need is a good idea and some dedication. Take action now!